Just when you think things couldn’t get much more bizarre in Oxbow, ND – the economic blight and limbo continues.

Without question, Oxbow Mayor Jim Nyhof did more to tarnish the public perception of Oxbow being flood prone than anything mother nature could muster.

During nearly every media opportunity, Nyhof decried how terribly the flooding impacted Oxbow, ND until permanent flood protection was constructed during 2010-2011. At which point Nyhof praised the near 500 year flood protection in Oxbow, ND – but decried the black cloud hanging over Oxbow, ND as a result of the proposed Fargo Dam and FM Diversion project threat to the future of the community.

Instead of using a rational approach and relocating as many existing structures as possible to minimize costs to taxpayers, Oxbow’s elite negotiated a sweet deal for the Exclusive Oxbow Country Club and around 40 homeowners into massive buyouts for one of North Dakota’s wealthiest communities. The largest buyout-relocation being the Oxbow County Club at $10.49 million, which was $600,000 in debt – according to Oxbow Mayor Jim Nyhof, before the OHB ring-dike-levee was considered.

The entire OHB project was presented as a $65 million project, which is currently over $92.8 million and climbing.

Aside from all of the proponents rhetoric and reasoning used to justify the Oxbow debacle, the state and county taxpayer has funded golden parachutes averaging 364 percent.

One can fully appreciate that CCJWRD (Cass County Joint Water Resource District), Cass County Commission and the FMDA (Fargo Dam and FM Diversion Authority) is largely INCOMPETENT when it comes to Oxbow, ND. “They” are so intently focused on stifling opposition that the philosophy is “costs be damned”, the end justifies means. Even to the extent that the decision makers resorted to corruption and rigged an assessment vote to further the development agenda disguised as flood control.

So here is the rub. A property owner could take a buy-out and leave or choose to relocate with various incentives and perks that included a brand new home.

Here is where things get sticky. If an existing value is artificially augmented in the process of buyout-relocation ~ providing equity enrichment, which is funded by the taxpayer, should a property owner be allowed to additional enrichment as a result of the process?

For Example:

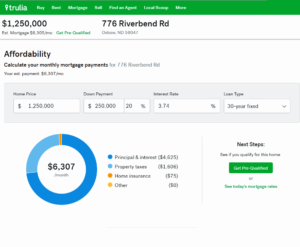

Several online real estate sites have been promoting the property address of 776 Riverbend RD, which exists as a buyout-relocation from the previous address of 805 Riverbend Rd.

Taxpayers have already coughed up an additional $610,258 in equity enrichment on the property buyout of $888,158.

In this case the original Cass Tax Valuation was $277,900 and the current asking price is $1,250,000 which would net an equity enrichment of $972,100 since the OHB project began. It will be certainly interesting to discover how the cost basis is established to offset the asking price, to determine capital gains at the time of sale.

Ironically, the entire project was to address “being in limbo” and preserve the community as a part of the Kindred School District. So how is it possible for a property and structure listed at $1.25 million to pay only $506.10 to the Kindred School District, when the remainder or residences in the Oxbow, Hickson, Bakke area are paying more?

So lets say the property sells for the asking price…, it is not necessarily a win for the community.

A) It could establish a higher tax valuation and property valuation for the community, wherein, a smaller group of buyers may qualify for financing and everyone will pay more in property taxes because a select group was handed a financial windfall opportunity.

B) If the property languishes on the market, neighboring properties become less attractive to buyers and lenders.

Either way, the “black cloud” has not been removed…, it just morphed into a more serious financial impact.

The big head-scratcher is how will the newest homes in Oxbow be valued for tax purposes?

The website www.trulia.com suggests property taxes around $1,600 per month for 776 Riverbend RD and a whopping $6,307 (30 year) mortgage payment based on a $250,000 down payment and $1.25 million asking price.

Given the general rule of thumb of maximum Debt to Income ratio of 36 percent, prospective buyers in Oxbow would need an annual salary in the neighborhood of $250,000 to qualify for a 30 year mortgage.

According to the US Census Bureau, the Median Household Income in Oxbow, ND is $133,438.

The “black cloud” hanging over Oxbow, ND is not flood waters, lack of home sales or refinancing. It is the inequity created by Oxbow’s elite in an opportunistic effort to orchestrate golden parachutes for around 40 homes and the Exclusive Oxbow Country Club.

…and the taxpayer gets stuck with the check.

Views: 1460