Kristin Daum, reporter for the Fargo Forum, posed a question in her February 5th, 2012 article titled:

“Diversion Discussion: Timing of Cass County tax

remains questionable among diversion critics”

– Excerpts from the article in RED –

The question posed:

“Was it a conspiracy to advance the project, or was it simply bad timing?”

In all reality, it doesn’t matter if it is/was a conspiracy or whether it is/was bad timing – because neither hits the underlying point.

Voters cast their ballots on the thin details as it they were presented prior to the vote and were given another project with different details after the fact.

It would be no different than purchasing a one way ticket to Chicago and being abandoned in Los Angeles. At the very least, there is a breach of trust in the Diversion Authority, Fargo, Cass County Commissioners and the USACE.

“The first indicator that the corps might change the project’s components came in mid-September, about six weeks prior to the county vote. Corps officials pushed back the fast-tracked timeline for the diversion study, citing the need to take a closer look at the downstream impacts and find suitable alternatives.”

Any of the aforementioned entities had an obligation to taxpayers to disseminate any and all pertinent details in a conspicuous manner so that an informed decision could be made on support or non-support of ballots being cast.

When voters cast their ballot on a tax measure, they are entering into what could be loosely defined as a social contract.

What are the basic requisite of any contract?

Under North Dakota Century Code

9-01-02. Requisites of contract.

It is essential to the existence of a contract that there should be:

1. Parties capable of contracting;

2. The consent of the parties;

3. A lawful object; and

4. Sufficient cause or consideration

9-03-01. Requisites of consent.

The consent of the parties to a contract must be:

1. Free;

2. Mutual; and

3. Communicated by each to the other

| QUESTION: | Are Cass County commissioners exercising due diligence as [1. Parties capable of contracting;] when financial support for a Fargo flood control project is imposed by tax measure onto economies outside Fargo? |

| QUESTION: | Is [2. The consent of the parties] upheld when the consent of the ballot does not reflect the details under which the vote was obtained? |

| QUESTION: | Is the Fargo Moorhead Dam and Diversion [3. A lawful object] when it violates Executive Order 11988? | QUESTION: | Was [4. Sufficient cause or consideration] given when the USACE became aware of changes, pushed back the fast-tracked timeline for the diversion study, but failed to be transparent with details that would have invariably changed the outcome of the tax vote? | QUESTION: | Was the tax measure presented [1. Free] and unfettered when Fargo receives double representation from city government and county government? | QUESTION: | Is there [2. Mutual] consent when the Fargo Moorhead Dam and Diversion project clearly differs from the consent voters cast their ballots? | QUESTION: | Was the tax measure [3. Communicated by each to the other] when the entire scope of a three year study of the Fargo Moorhead Dam and Diversion changes in six weeks and doesn’t get released until after the tax vote? |

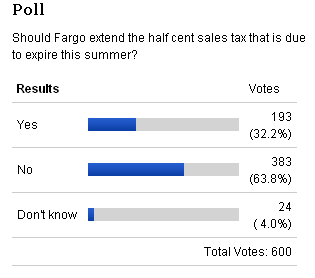

Kristen Daum was quick to point out that: “64 percent of Cass County voters approved the half-cent sales tax on Nov. 2, ensuring a local funding stream to help pay for the diversion.”

However, Daum failed to include that the Fargo Forum’s recent poll initiated January 30th, 2012 revealed that 63.8 percent of voters would not be in favor of extending the half cent sales tax for flood protection.

Perhaps, Fargo and Cass County officials realize that taxpayers are fed up with taxation and project misrepresentation?

Based on the information presented in Appendix C of the USACE – FEIS; Currently, taxpayers are on track to spend at minimum $36,825 per residential and business structure in the metro area for the Fargo Moorhead Dam and Diversion.

Which, at present costs, will have taxpayers spending at minimum $7,160 – $10,229 per residential and business structure in the metro area to force families from outlying farmsteads, rural properties and the wholesale destruction of the communities of Bakke, Hickson and Oxbow.

Think about that! Taxpayers will fund at minimum $36,825 per residential and business structure so that the elite land developers can directly benefit from a taxpayer funded venture to assist them in developing the natural flood plain buffer south of Fargo.

Could this be why a campaign has been initiated to rally support for tax extension to ensure the project continues moving forward?

Taxpayers are smart enough to realize that the elite land developers that are relying on Dennis Walaker, Darrell Vanyo and Tim Mahoney to push this project through have a vested interested in the Fargo Moorhead Dam and Diversion project.

The Fargo Forum indicated that of the $20.5 million collected with the flood sales tax, more than $52 million has been spent on various inner-city protection projects with only $2.9 million designated for diversion related expenses.

Fargo’s $49 million funding of inner-city protection has exceeded “thus far” the entire $48 million construction price tag of the FargoDome. Of that $49 million, $18.7 million was spent on permanent dikes and levees.

It would be interesting to ascertain what portion of the $18.7 million was allocated to the project along Rose Coulee which runs adjacent to Diversion Authority board member,Tim Mahoney’s 4628 Timberline Dr S, Fargo, ND residence.

If this project passes, taxpayers will be saddled with the burden of funding the equivalent of more than 37.5 FargoDomes in 2012 dollars!

On a completely odd but related note on how history tends to repeat itself. The FargoDome was originally presented as a structure similar to the Tacoma Dome, however, the design was entirely changed to the current “non-dome” structure.

What say you…?

Views: 205