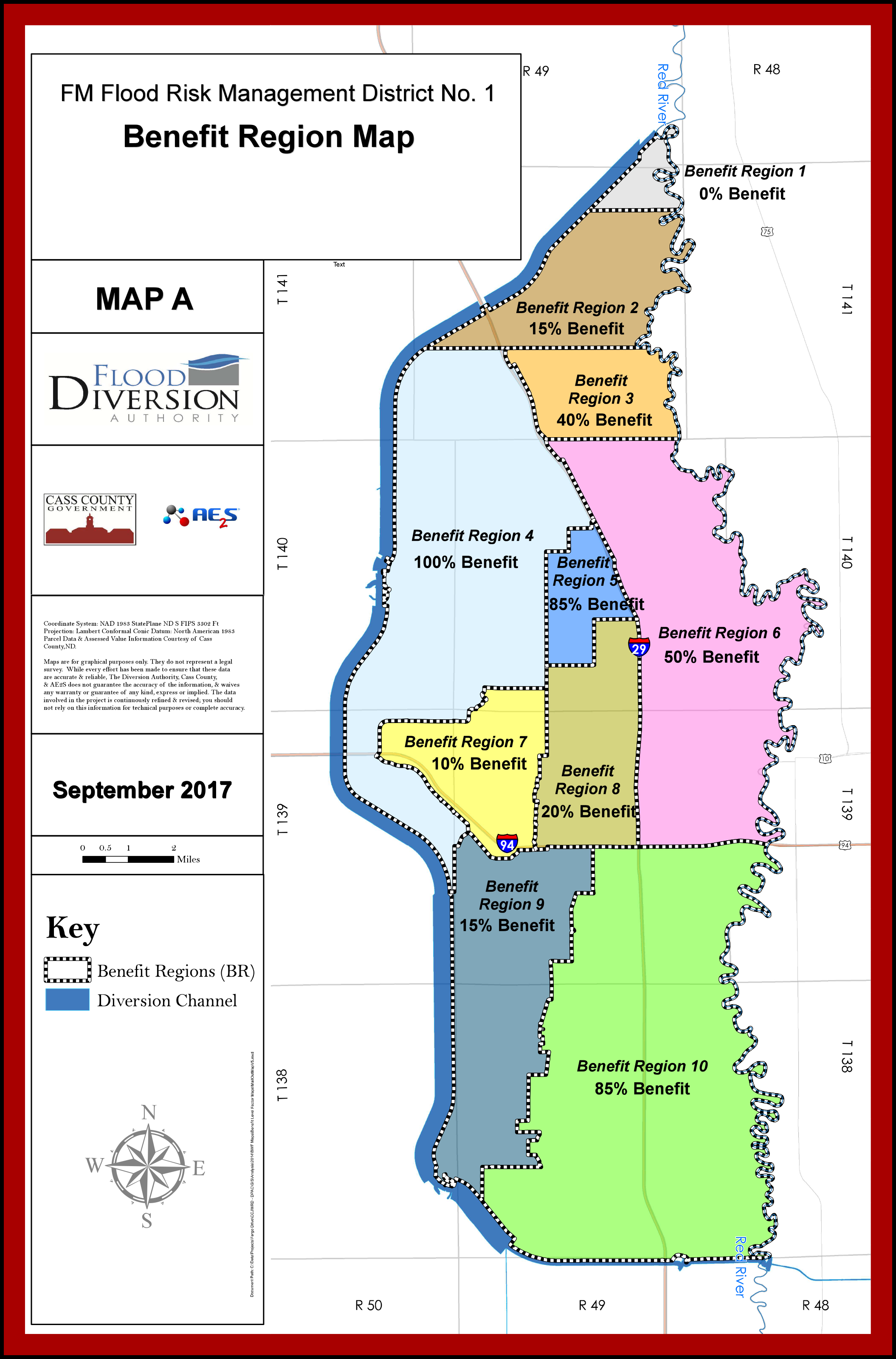

Click for Large View

Richland-Wilkin Joint Powers Authority

Original Publication Date: May 10, 2018

Wahpeton Daily News

Republished with permission from:

JPA Editorial Board

Diversion area property owners should brace themselves for special assessments. Financial planners projected annual retail sales in Fargo and Cass County to grow by three percent a year over the life of the 50 year tax. Instead, revenues have fallen by four percent per year for the past three years, creating a breach in the funding plan. Sales data from the North Dakota Tax Commissioner’s office, shows taxable sales in Fargo have dropped $358 million over the last three years. They have to stop the bleeding downtrend.

Eastern North Dakota has not seen the recovery in retail sales that the western part of the state has. The oil industry has stabilized and a developing business support structure keeps more of the spin off taxable sales local. Agriculture is the resource that drives the Red River Valley economy. Commodity prices that fell dramatically several years ago, have remained depressed, with no real prospects for a near term recovery. The burgeoning list of department store closings in the region reflects a change in purchasing patterns by consumers. Internet sales with front porch delivery in a rural marketplace is taking its share of the pie.

Shoppers send one percent of every purchase made in the city of Fargo to flood control, and just under half that amount is designated by Cass County to go for the diversion. Sales tax supporters argued that since 40% of revenue would come from out of town shoppers, it was a great deal for Fargo residents. Those mechanics are what casts a dark cloud over sales tax growth. Not all online businesses collect sales tax from customers, but if they do, the sales tax is attributed to the municipality where the purchaser lives. If a Clay County shopper buys shoes online, they pay no sales tax because Minnesota doesn’t tax clothing. If a Richland shopper buys tools online, they pay tax to their home county. Cass County residents who live outside the city limits of Fargo, and place the proper extension digits on their zip code, pay only the county’s share of the flood tax if they shop online.

Revenue projections are only part of the financing dilemma forcing the assessment issue. Spending on the stalled project is hemorrhaging at a higher rate than tax collections. The Oxbow project has doubled in cost and isn’t close to completion. Levee construction in Fargo is estimated to double its original price tag, and that too isn’t finished. Giving no comfort to prospective taxpayers, are the two St. Paul Army Corps diversion projects they have been built in Minnesota that doubled in cost, and they were a fraction of the size of the Fargo plan.

The diversion assessment district creators passed their plan over the objections of voters. The government entities had more votes than the property owners and made no secret of it. We’ll see who stands to defend the assessment district when the first notices for payment arrive.

Views: 977