A Tale of Two Taxations

Talk to people and you learn stuff.

Property taxes. Cass County has been rather obsessed with them over the past decade or so, routinely sending assessors out to the county’s communities to spread taxation fairness. Yes, it’s all a matter of making certain that everyone is taxed ‘fairly’. If you don’t believe me, just ask the County Commissars. Surely, they will be happy to look down from above and explain it to you.

But, how does the county define fairness? Well, let’s take a quick look at a couple of properties to see if we can figure that out.

Property 1: 121 Oxbow Drive, Oxbow

After the FM Diversion Authority (DA) announced its plan to flood thousands of upstream acres back in 2010, many properties upstream from Fargo were left in a state of economic uncertainty. Such was the case with 121 Oxbow drive. It’s former owners, an elderly couple who needed to move, found their home to be unsaleable. It took time, pressure and shaming but the DA eventually agreed to a ‘hardship buyout’ of this property.

It seems the initial valuation of the home came in at something over $500,000 but the DA rejected it. They had the home inspected and after multiple appraisals and negotiations, the DA was successful in reducing the hardship buyout value and manipulated acquisition in 2013 for $370,050 (per Zillow).

As 121 Oxbow Drive was not one of the 40-plus properties ultimately slated for removal, the DA eventually resold the home in 2014. Having purchased it for $370,050, the DA sold it for $200,000 (again, per Zillow). Now, here’s the kicker: in 2017, the property was taxed on a valuation of $452,400. That’s 226 percent of the 2014 purchase price.

I think the word you are looking for is Schizophrenic.

Property 2: The Oxbow Golf and Country Club

You would have to be living under a rock to have missed this deal. As part of the as-yet unpermitted FM Diversion project, the work to encircle Oxbow, Hickson and Bakke with a ginormous levee has proceeded apace, including the complete redesign, expansion and reconstruction of the private 18-hole Oxbow golf club. New clubhouse, new pool, new parking lots, new driving range, new mounds and hills, new lakes and bridges, new irrigation and drainage systems, concrete cart paths throughout.

The estimated cost of the Oxbow Country Club, as published in the Forum and by the DA itself, has ranged from about $26 million to $32 million. To arrive at the true final cost may take a forensic accountant’s expertise but it seems safe to guess $30 million or more, perhaps much more. And all of this has been done on the taxpayer’s many, many, many dimes. The project isn’t complete yet but it’s close.

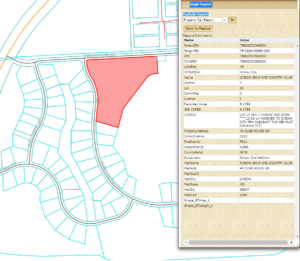

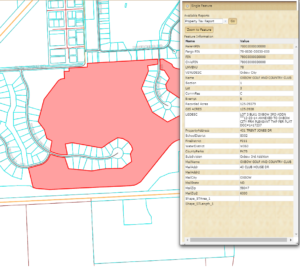

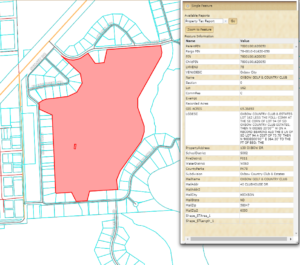

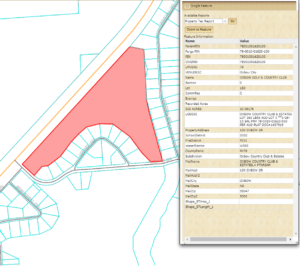

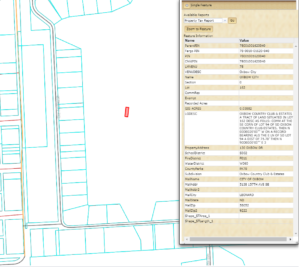

So, what might you guess is the 2017 taxable valuation for this brand new, 18-hole private country club? The property appears to be broken up into five parcels (see maps below) with a total taxable valuation of $4,473,400. If we assume a total taxpayer investment of $30 million, then the taxable value is 14.9 percent of what the buyer (that would be you) paid. The difference in this case, however, is that your only hope of getting anything back on your $30 million investment is through the taxes paid on it.

|

|

|

| Oxbow Country Club (Clubhouse Parcel 1) | Oxbow Country Club (Course Parcel 2) | Oxbow Country Club (Course Parcel 3) |  |

|

| Oxbow Country Club (Course Parcel 4) |

Oxbow Country Club (Course Parcel 5) |

The parcel on which the new clubhouse, pool and parking lot sit is valued at $2,747,100, an amount approximately $40,000 greater than what you paid to purchase the home and property at 5059 Makenzie Circle, just north of and adjacent to Oxbow. You have also paid over $2 million apiece for three homes built in Oxbow, none of which come close to rivaling the structure that is the new Oxbow clubhouse. With these properties for comparison, it appears that the new clubhouse is seriously undervalued for taxation purposes and most likely cost more to construct than the 2017 taxable valuation of the entire country club.

Given these two properties and the buyers of each, are they being treated fairly? A better question: are they being treated equitably? That’s up to you to decide. As for this Angry Taxpayer, Cass County’s definition of fairness is clear as mud and ‘fair’ still comes to town once a year.

Views: 904