If you have a concept of what “white privilege” is, then understanding the concept of “Oxbow Privilege” shouldn’t be too large a leap.

Oxbow’s elite are truly living in their own little world, where conventional rules don’t apply and the entitlements of wealthy welfare are doled out like candy at a parade.

With nearly $32+ million in taxpayer dollars pumped into the the private and exclusive Oxbow Country Club, what do North Dakota taxpayers really have to show for it, aside from the inequities that surround the Oxbow project?

Every Oxbow Country Club buyout and relocation would have to pony up over $ $107,500.00 thousand per year for 30 years to repay the North Dakota taxpayers for the tax dollars funneled into luxury buyouts to mitigate a community that already had near 500 year flood protection and salvage a golf course that was characterized as being $600 thousand in debt.

One reader pointed out, in response to Oxbow Country Club Demanding More Money, that it was rather convenient that Oxbow Country Club received $600,000 for the old lower course holes, essentially wiping out their debt.

The average home buyout with “betterments” in Oxbow, ND is around 365 percent of tax valuation. The $10.5 million Oxbow Country Club buyout in 2015 wasn’t enough and an additional $2.43 million going to Oxbow Country Club, for unidentified costs, pushes the Oxbow Country Club buyout and “betterments” to 1,292.92 percent of the 2013 tax valuation.

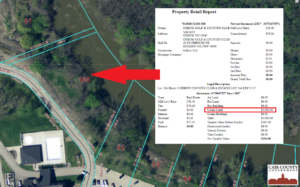

Oxbow River Lot 164 Cannot Be Developed

Valuation Is Higher Than Golf Course Acreage

How is this fair and equitable to other property owners displaced in Cass and Clay counties impacted by Fargo’s boondoggle that received only tax valuation or less?

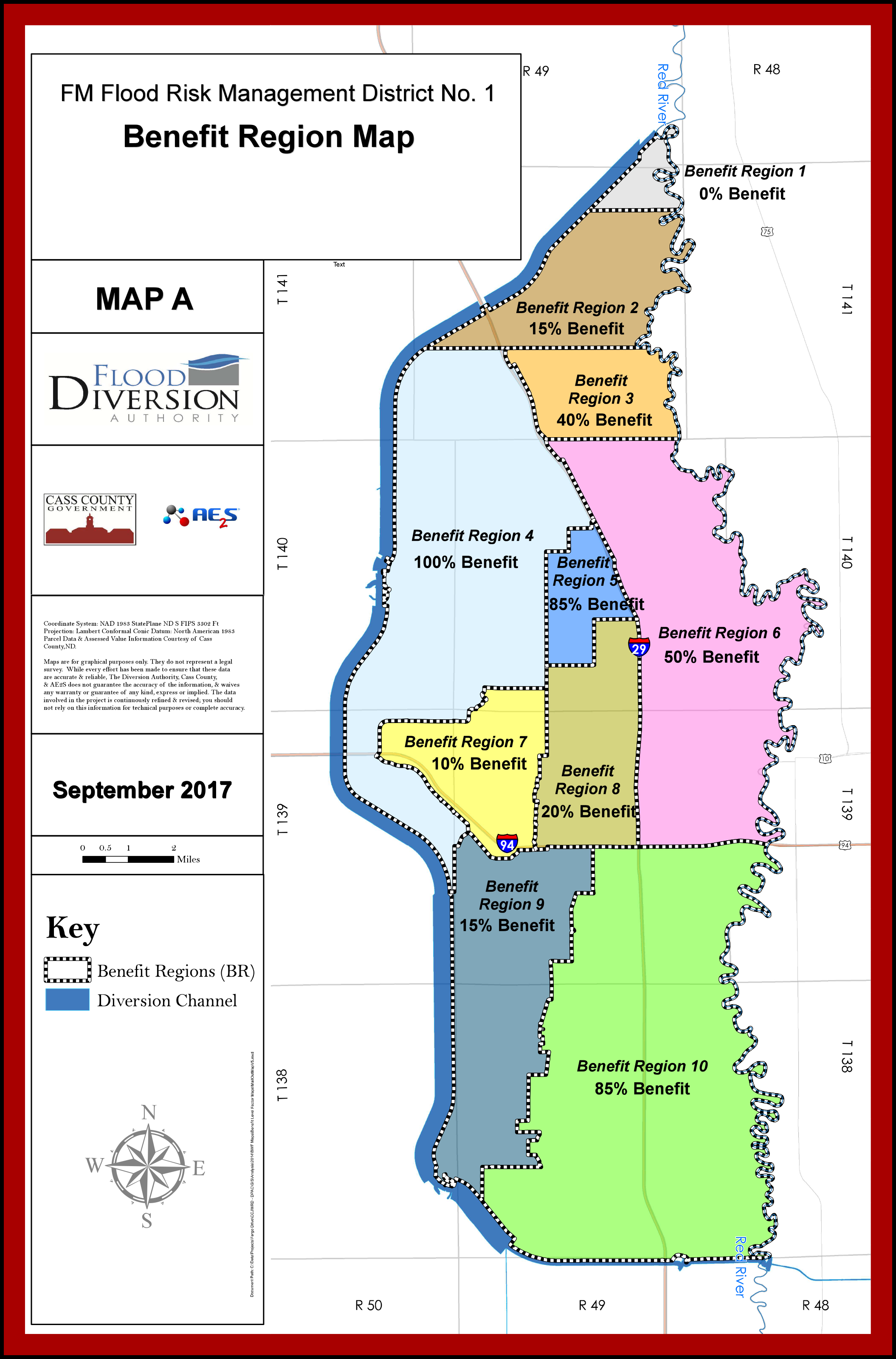

It shocks the senses when the FMDA (Fargo Moorhead Diversion Authority) and CCJWRD (Cass Country Joint Water Resource District) purchased land for Oxbow’s new golf course and residential lots for around $25,000 per acre and then show favoritism to the Oxbow Country Club by lowering the land valuation to $2,498.13 per acre.

There is a long list of inequities that favor the Oxbow Country Club but how is it possible for the Oxbow Country Club to golf course acres to be valued around $2,498.13 per acre when Oxbow Country Club Lot 164, which can never be developed, is valued “higher” at $5,900 per acre?

Look at these Oxbow Country Club comparisons:

| 2013 | 2017 | Change | |

| Average Valuation Per Acre | $4,807.35 | $3,119.30 | -35.11% percent |

| Oxbow Country Club Acreage | 154.95 acres | 223.70 acres | +44.37 percent |

| Oxbow Club House Square Footage | 13,879 sq/ft | 33,556 sq/ft | +141.78 percent |

| Golf Course Pool Square Footage | 1,600 sq/ft | 4,224 sq/ft | +164.00 percent |

| Oxbow Club House Valuation | $344,300.00 | $3,781,500.00 | +998.32 percent |

| Oxbow Country Club Valuation | $1,000,300.00 | $4,479,300.00 | +347.80 percent |

| Oxbow Valuation vs Costs | $1,000,300.00 | $32,054,262.26 | +3104.46 percent |

| Property Tax Liability | $55,513.00 | $57,902.29 | +4.30 percent |

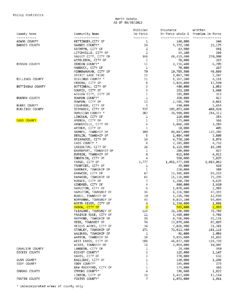

Oxbow, ND FEMA Flood Policies

as of June 30, 2013

Over $129 million into Oxbow, ND mitigation as of June 30, 2018 – all predicated under the false pretense that Oxbow, ND was flood prone – with only 2 FEMA flood policies enforce in 2013, before the project began.

Living in a Bubble is the essence of not living in reality.

The Oxbow Country Club “bubble” is no exception. A mindset of entitlement, the wealthy welfare of “give me more”, the willful detachment from the roots of sensible suspicions and forthright friends.

Drive by and take a look at the taxpayer subsisized golf course…, it’s not the way it’s supposed to be.

Oxbow Country Club is registered as a “nonprofit corporation”…, which could never have achieved it current status by its own efforts.

The Oxbow bubble is a very tricky thing, all full of type, hype and lies…, a deceptive dream and living nightmare…

Views: 1087