With events unfolding in the aftermath of earthquakes near Anchorage, Alaska and the passing of former 41st President George H.W. Bush – it offers some perspective on how small and insignificant the Fargo Moorhead metro area really is.

Fargo appears to want the nation and state(s) to believe that Fargo’s irresponsible development plan disguised as flood control and self induced financial problems are worthy of priority status and that P3 investors should be clamoring for the chance to bail out bad decisions made by bad decision makers.

As the Minnesota DNR contemplates the determination of adequacy and whether to ultimately grant or deny the permit for the FMDA (Fargo Moorhead Dam and Diversion Authority) project ~ there are still major financial obstacles facing the proposed FMDA project and the lack of transparency continues to undermine credibility of the project and proponents.

Generally speaking, taxpayers and property owners are not aware that Fargo and Cass county have drawn over $150.25 million in loans without voter consent. These loans are held off FMDA books by the city and county, arguably, to improve the financial appearance of the FMDA project.

Even more staggering is that the FMDA has paid over $6 million in interest and fiscal agent fees on the $150.25 million in loan advances since September 2015.

Curiously, the FMDA indicated that Bond Debt Payments totaling $4,875,880 were made on June 18, 2018 – yet the principal balance of $150.25 million remains unchanged and interest is accruing on the entire balance.

So exactly HOW financially healthy is Fargo when debt payments don’t reduce the debt obligation?

Fargo is quick to suggest any hint of funding coming their way is a “win” and run it up the flagpole, but is the recent $35 million even headline worthy?

The FMDA wrote a check to the USACE for $45 million on 9/13/2016 and another $1.2 million on 3/29/2017 for construction of the diversion inlet structure – yet the temporary injunction handed down by United States District Chief Judge John R. Tunheim on 9/7/2017 ensured that the bulk of the $46.2 million paid to the USACE for the “hole to nowhere” remains unspent.

Isn’t the recent $35 million in funding really just a case of the USACE giving back to Fargo the money that Fargo first gave to the USACE?

Do a quick Google search with the term “Fargo diversion funding” or “Fargo P3” – there are little to no news items explaining or identifying the P3 (Public Private Partnership) providers or the lending terms that will financially encumber local taxpayers and property owners.

However, on October 14, 2018 the printed copy of the Fargo Forum ran a headline “Fargo’s Financial Health In Question” (read more…).

How is it possible for a front-page article, from the region’s leading newspaper, to not appear in online searches? It is almost as if proponents of the project are trying to intentionally craft a narrative that prevents decision makers from seeing the true health of the FM Metro Area and they are using the archaic medium of printed newspaper to claim they’ve done their due diligence to inform the public.

Fargo Finance Director Kent Costin was cited in the article:

“…I’m of the opinion – I’ll say that straight out – that if we don’t change the trajectory of our budget and maintain these reserves and things start to look a little brighter, we will get a downgrade in our bond rating,…”

Kent Costin also stated:

“…In 2011, with a robust state economy, the debt load was 52 percent of sales tax revenues for the year. In 2017, it was 152 percent of revenue…”

Remember back in 2017 when property valuations were going up across the board? It was nothing more than a dirty scheme to pump up city reserves without raising the mill.

According to Kent Costin:

“…if specials ever fell short, the city would have to raise the mill levy. He said Moody’s keeps a close eye on the General Fund because it wants to know the city has the capacity to do so; bigger reserves means the city doesn’t have to lean as hard on taxpayers…”

Well, Well, Well…, isn’t that interesting. Moody’s Investors Service is concerned about “leaning hard on the taxpayers” – So how does inventing a higher property value, out of thin air, which allows the city and county to net more tax revenue, without raising the mill, not get viewed as leaning hard on taxpayers? With the cost of living outpacing wages in the FM Metro – isn’t the taxpayer just being forced to shoulder the spending spree of a broken system that does not represent the best interests of the taxpayers?

What does this mean to you? Did this mean that you had no control over the city or county from devising a way to take more money from you, that allows them to borrow more money on your higher valuation, that you as the taxpayer will have to pay back, leaving you less in your pocket?

When Rocky Schneider of AE2S peddled to concept of indirect benefits (read more…) associated with the DPAC (Diversion Project Assessment Committee) assessment vote, the sky was the limit and historical sales tax was touted at 4 percent growth – Fargo and the metro were too big to fail…

After 4 years of flat or declining sale tax and multiple store closings locally, regionally and across the nation – it appears that Schneider lacked any credible financial foresight, bluffed his way through the DPAC process and rigged the DPAC vote to ensure the agenda encumbering property owners was met.

The most despicable aspect of the DPAC vote (read more…) is taxation without representation. $426.9 million in potential tax assessments were shifted, hidden and intended by design to be absorbed within the general mill ensuring all property owners outside the FM Metro area will pay for a project that does not benefit them; and one that was not legally ratified by those shouldering the cost.

The DPAC process was supposed to provide a better bonding rate and Fargo turned around and used threat of property assessments to trick voters into ratifying a diversion sales tax until 2084. Yet the property assessment and sales tax were based on a project that hadn’t even begun construction and an estimated price tag that is around $3 billion shy of reality.

So what’s the big deal?

On May 15, 2017 Nathan Boerboom, City of Fargo Engineer and Eric Dodds, AE2S gave a power point presentation that shed some light onto how Fargo is misleading Washington and the Office of Management and Budget and most likely the MN DNR.

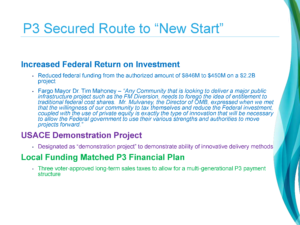

According to Fargo Mayor Tim Mahoney: “John Michael Mulvaney, the Director of OMB, expressed when we met that the willingness of our community to tax themselves and reduce the Federal investment, coupled with the use of private equity is exactly the type of innovation that will be necessary to allow the Federal government to use their various strengths and authorities to move projects forward.”

Willingness? Pretty sure that project proponents forgot to share that the city and county corrupted and usurped the DPAC vote against the will of the people; and that Fargo Mayor Tim Mahoney used city letterhead to intimidate business owners (read more…) to vote a certain way; and that proponents framed the sales tax and property assessment as an either or decision; or that proponents resorted to fear mongering and embellished FEMA flood insurance costs.

Anyone that has applied for a car or home loan can relate to demonstrating a healthy financial picture for the bank – but it still comes down the rating of credit worthiness.

Costin’s earlier statements speak volumes about the financial games being played by the “powers that be” but his reference to a rating downgrade is also very misleading.

On July 9, 2018 Moody’s Investors Service noted “Outlook revised to negative” for Fargo, ND.

On August 9, 2018 Moody’s Investors Service noted “The outlook is negative” for Fargo, ND defining the Rating Outlook as:

“The negative outlook reflects our expectation that the local economy growth has begun to slow, reflected in fiscal 2017 and year to date local sales tax declines, and a still growing but moderating tax base, which may not keep pace with the city’s plans for additional borrowing on an already elevated debt burden. – Moody’s”

Moody’s Investors Service cited several factors that could lead to additional downgrade:

| • | Growth in debt and fixed costs ratios |

| • | Stagnation or declines in the city’s tax base signaling a reversal of the city’s strong economic trends |

| • | Deterioration in operating reserves and liquidity |

| • | Final determination of local share of financing for $2.1 billion flood mitigation project and impact to direct and overlapping debt metrics |

Contemplate this excerpt:

“…continued to spend freely with the support of voters, politicians from both parties, employees and bondholders. Rating agencies were quiet about any risks…”

Sounds a lot like Fargo, doesn’t it?

The excerpt is from a July 3, 2012 Reuters article titled “How Stockton Went Broke – A 15 year Spending Binge” (read more…), ~ described as a quiet farming town with a population around 300,000. Moody’s Investors Service indicated in a March 27, 2012 ratings action report that approximately $341 million of debt played a role in the downgrading of Stockton’s obligation bonds.

On June 28, 2012 – Stockton, CA filed for Chapter 9 Bankruptcy Protection (read more…).

Click here for more information on Stockton, CA Chapter 9 Bankruptcy

It wouldn’t be a circus without the elephant!

Which begs the question, what is Moody’s Investors Service financial snapshot of Fargo and the metro area spending binge? Y’know…, that elephant in the room?

| 2018 Population: 198,446 (est.) | ||

| Entity | City Debt | School Debt |

| Fargo, ND (view report…) | 467,100,000 | 98,900,000 |

| West Fargo, ND (view report…) | 326,000,000 | 201,000,000 |

| Cass County (view report…) | 126,300,000 | |

| Moorhead, MN (view report…) | 173,700,000 | 109,700,000 |

| Debt Sub Total | 1,093,100,000 | 409,600,000 |

| Combined Debt | 1,502,700,000 (1.5+ billion) | |

With nearly 1.1 billion in general obligation debt and more than 409 million in school debt, how will the MN DNR or P3 provider(s) resolve the socio-economic catastrophe that would unfold if the DNR were to permit the project that the region cannot afford?

How can any PPA (Project Partnership Agreement) or P3 (Public Private Partnership) entity consciously involve themselves in the debt cesspool that the FM Metro area is currently mired in?

| Expanding Project Cost | ||

| Year | Est. Cost | Memo |

| 2005 | $ 400 million | FMUS (Fargo Moorhead Upstream Study) Distributed Retention could provide 1.6 feet (19.2 inches) of flood reduction. |

| 2010 | $ 1.3 billion | Original Minnesota Alignment FCP |

| 2011 | $ 1.8 billion | FMDA decided on North Dakota Aligment LPP |

| 2016 | $ 2.126 billion | Mission Creep: In Town Levees, Oxbow Country Club, OHB Ring Dike |

| 2018 | $ 2.75 billion | Mission Creep: In Town Levees, Oxbow Country Club, OHB Ring Dike |

| POTENTIAL | $ 4-5 billion | Minimum Potential Cost (in 2018 dollars) |

The USACE has a dismal record of keeping projects on budget.

The most recent failure at Oxbow, ND – touted as a $65 million project, currently not complete, stands at over $129.5 million with around 2.3 miles ($30 million more) of levee work and road raises still to be done.

If you can acknowledge the circus, the clowns and the 900 pound gorilla facing off with taxpayers…

Isn’t a flood, the least of Fargo’s worries?

Views: 1392

If this project moves forward, be honest with the public as to how they will be paying for a project that will for various reasons exceed $4,000,000,000?

It is hard to believe that a the DA thinks they will have funding from any source.The time it takes for the DA to give up on the new development area and work for flood protection for the citizens of Fargo could be better served by finishing intown levees and using the natural flood plain for flood storage. Billions of tax dollars would be saved.