Oxbow North Dakota Greed…, that social manure that Oxbow’s elite spread as thick as cream cheese on a bagel.

As of February 28, 2017 – documents from the FMDA (Fargo Dam and FM Diversion Authority) indicate that taxpayers have sunk over $92.5 million into the Oxbow Country Club and home relocates, under the guise of “housing of last resort” mitigation for approximately 42 homes, which nearly all could have been moved into the new area of the golf course.

$92.5 million: equal to a brand new FargoDome and a 582 space parking ramp in 2017 dollars.

The entire mess began as a posturing bluff, presented to local residents by Oxbow Mayor Jim Nyhof, in efforts to either get a seat at the FMDA table for some semblance of representation or to drive mitigation costs so astronomically high that it would be unfathomable that the FMDA would continue with the amoral Fargo Dam and FM Diversion project.

Oxbow, Hickson and Bakke stood united and opposed to the unjust FMDA project…, or so people thought.

Taxpayers had already spent nearly $353,352 on flood control measures in Oxbow, ND during 2010-2011 with additional upgrades into 2013. However, around mid 2011 Oxbow’s elite began contriving a better deal for themselves and they only needed to dangle the ambiguous carrot of money grown in a heaping dose of social manure to get residents filled with anxiety and into believing that all their problems would be resolved if they just stick together.

Where did all the anxiety come from? The FMDA was absolutely tone deaf to any discussion that was not aligned with Fargo’s development plan disguised as flood control and Oxbow Mayor Jim Nyhof used every media opportunity he could to characterize Oxbow as being flood prone and how terrible it was to live within the “limbo” of economic blight. Oxbow, ND went so far as to argue a 20 percent tax abatement via their woeful tale despite Nyhof, being the very same person that admitted in writing that Oxbow, ND had nearly 500 year flood protection in a letter to Terry Birkenstock (view letter). Of course, Nyhof later attempted to backpedal and claim that Oxbow’s robust flood protection was flawed and was not “certifiable”.

Let the word “certifiable” sink in…, we will get back to that in a moment.

So which is it Nyhof…, Oxbow “IS”… or “IS NOT” flood prone? Nevermind…, you’ve shown your true colors.

It appears that Nyhof may be confused, biased or incompetent over the entire matter. Perhaps FEMA, the agency that ultimately determines whether or not NFIP (National Flood Insurance Program) is required, might be a better resource in establishing the factual flood risk of Oxbow, ND.

According to FEMA, in Oxbow’s entire history there have been only 15 FEMA claims filed totaling $243,127. FEMA buyouts that followed the 2009 flood left approximately 102 homes remaining with a total of 3 FEMA NFIP policies in-force, and one of the three policies was known to be an elective (not mandatory) policy.

As of December 31, 2016 there were 4 FEMA policies in-force (view detail) totaling $1,400,000 in covered valuation with a combined premium of $1,651.

Hmmm…., only 4 out of nearly 102 properties in Oxbow, ND carry FEMA NFIP flood insurance. Wouldn’t that suggest that 96 percent of Oxbow, ND is not flood prone, despite mayor Nyhof’s assertions to the contrary? It certainly appears that the mayor and Oxbow’s “elite” have done more to damage the desirability of Oxbow, ND than anything the mighty Red River has thrown their way.

Think about it.., even though FEMA does not require over 96 percent of Oxbow, ND to carry flood insurance, Oxbow property owners (if they truly felt they were “flood prone”) would be purchasing FEMA flood insurance policies to protect their interests…, right?

“Certified Flood Protection” is nothing more than a pervasive lie. A false metric contrived to advance the agenda(s) and narrative(s) of FMDA proponents in their nefarious efforts to bleed the taxpayer to the financial benefit of developers.

Does any rational person in the Red River Valley truly believe that fiscally strapped FEMA won’t end up requiring flood insurance despite the construction of flood protection measures? According to the GAO (General Accountability Office) as of March 2016, FEMA is $23 billion in debt. (view excerpt)

Flood control measures do not remove the risk of flooding.

Speaking of removal…, Oxbow’s elitist brain-trust charged ahead and removed significant portions of the existing near 500 year flood protection, without holding one public meeting or consent of the affected property owners. All to accommodate unnecessary golf course features with the “look and feel” of the newest Robert Trent Jones replacement holes on Oxbow’s south side. Rather interesting that a recent FOIA (Freedom of Information Act) request to the North Dakota State Water Commission revealed that Oxbow failed to file a NOTIFICATION TO BREACH/REMOVE A DAM, DIKE, OR OTHER WATER CONTROL STRUCTURE. (view document)

Let’s do a quick review. Instead of purchasing the land, relocating the existing homes allegedly at risk – all for around $15 million – the taxpayer has paid over $92.5 million towards a USACE $126 million estimate that largely benefits members of a private golf course with mansions at an average price tag 360 percent greater than the homes they owned, which could have been moved…, and they willfully removed significant portions of taxpayer funded flood protection in a community that is allegedly flood prone… – ? –

Praise BE! Pennies from heaven, Oxbow’s elite should be happy with their taxpayer subsidized windfall…, so one would think.

During 2016, Vanguard Appraisals was actively evaluating properties in Oxbow, ND in an effort to bring deficient property valuations in line with a more accurate representation of true and exact value. However, the entire city does not benefit from the windfall bestowed upon the 41 percent that received new homes on Oxbow’s south side. There is a section of Riverbend Road that runs east to west which has become the proverbial “railroad tracks” which measures your social status.

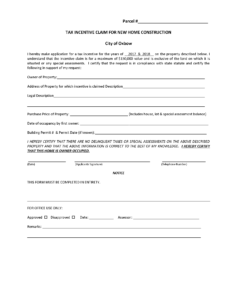

Oxbow’s elite even went so far as to concoct a TAX INCENTIVE CLAIM FOR NEW HOME CONSTRUCTION to avoid property taxes on the equity enrichment the North Dakota taxpayer has given them.

According to the most recent FMDA Expense Reports – Oxbow’s Top 10 most costly homes on Vanquard Appraisals valuation list cost the taxpayer over $14.1 million but were only appraised at $9.2 million. In short, those that received the most equity enrichment will avoid paying taxes on over $4.8 million in property value.

However, one relocation property in particular has not yet been built. FMDA documents indicate the buyout and relocation could top $2.36 million and Oxbow City Council minutes suggest that the owner avoided the scrutiny of Vanguard Appraisal recent review.

| Excerpt: 12/21/2016 Oxbow City Council Minutes |

| “Mayor Nyhof gave update on Vanguard contract. Councilman Champ informed board that his house was on the do not appraise list and Mayor confirmed that it was one listed not to appraise and that Champ had no part in that determination as all flood buyout properties will not be appraised.” |

The cryptic meeting minutes appears to confirm reports of a 2016 document being presented to Vanguard Appraisers that purported an exemption for certain properties from being appraised.

The truly sad part in all of this mess is the fact that there are some really good people that live in Oxbow but are embarrassed to say where they are from because Oxbow’s elite have tarnished the name and are too psychologically paralyzed to right the wrong-doings out of fear of reprisal from Oxbow’s elite and their ilk.

So if you meet a person from Oxbow, ND in the wild – please don’t assume they are all arrogant, self-centered, disgracious, whiny, entitled, money grubbing, narcissistic, social manure barons teeming with vulgar sophistication.

Views: 2632